montana sports betting tax rate

31 rows Since the inception of legal sports betting in 2018 the Garden State has collected 1695. Open an online project and start working in the most developed betting market in Europe.

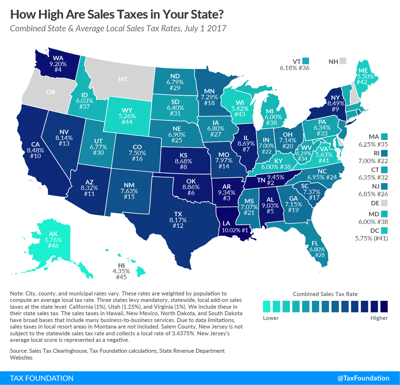

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

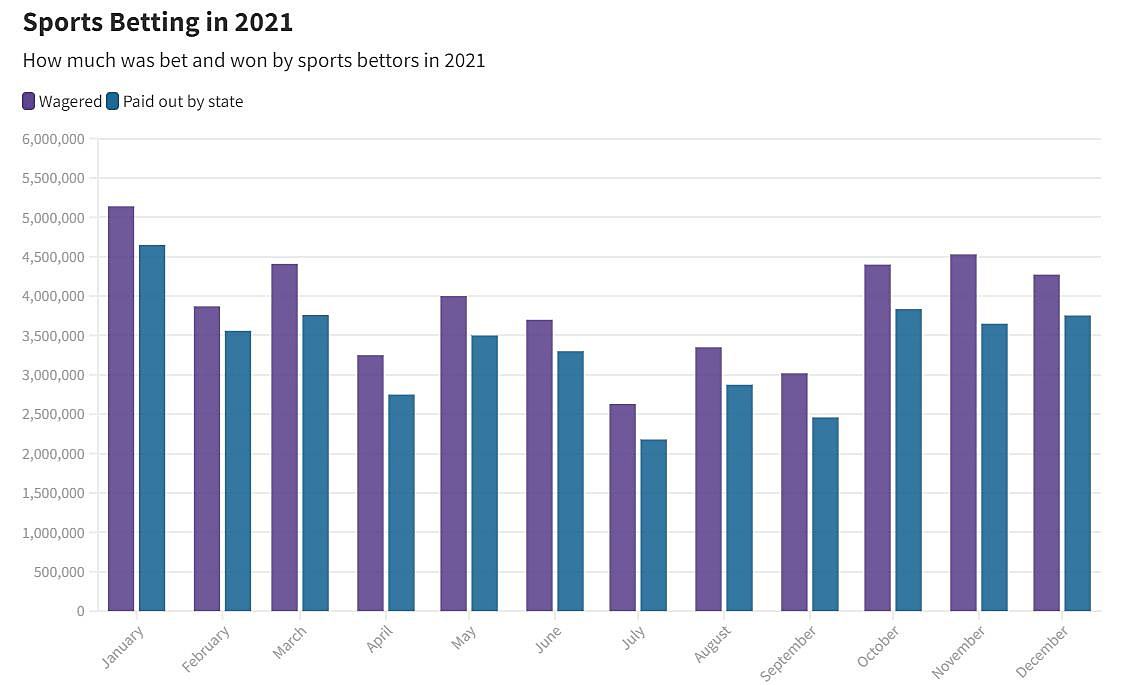

Since the legal sports betting expansion in 2018 the amount of sports betting revenue has increased dramatically.

. 2022 Montana sports betting. The major gambling tax in the state is the Video Gambling Machine tax which is equal to 15 of VGM expenditures. The lowest rate is 2 whereas the highest is just under 6 at 575.

What is the tax rate for Montana sports betting. Legal sports betting in Montana is now available to residents and visitors through the use of mobile sportsbook apps that can be downloaded to smartphones and tablets. - Federal taxes are currently.

The only exception is when children under 18 years are engaging in betting activities conducted by schools churches or other non-profit. Gambling Laws Administrative Rules. Information on local and federal gambling laws legal MT sportsbooks sports betting sites and MT mobile betting apps.

Taxes are withheld if the winnings minus the wager are more than 5000 and are at least 300 times as large as the amount of the wager. The state successfully introduced remote sports gambling options through the Montana Lottery in March 2020 at the. Montana Sports Betting Tax Rates.

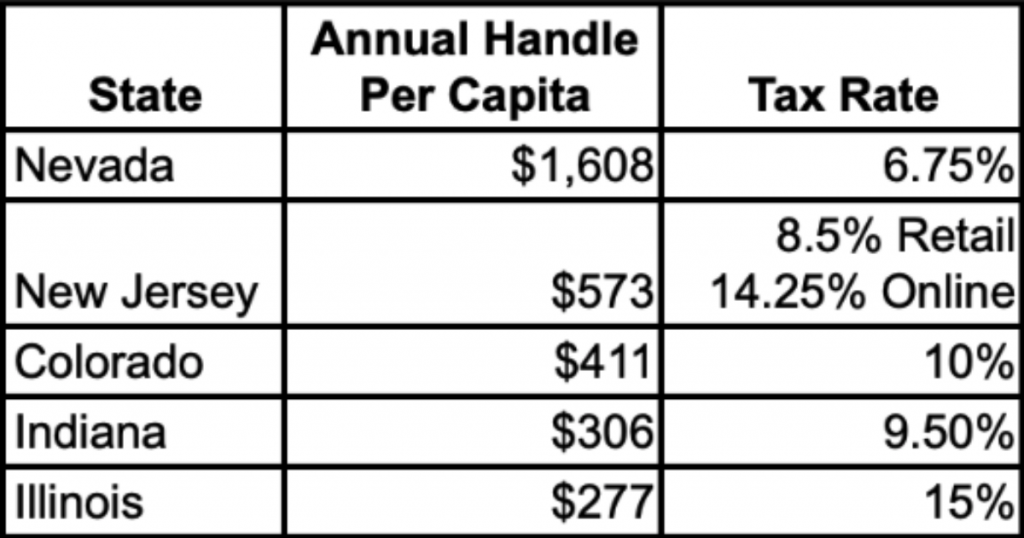

How States Tax Sports Betting Winnings. Even though it was later to the party than the likes of New Jersey and Nevada Montanas entry to the US sports betting sector didnt. Montana Sports Betting.

In Maryland there is a gambling winnings tax rate of 875. As opposed to taxing a set percentage of revenue the state of Montana keeps all sports betting revenue minus expenses. Add to that the roughly 4 million the state.

In this game the bookmaker expects the most probable total runs in the game to be 105. An effective tax rate of 36 and a 10 million licensing. In just four months of mobile operations New York state has generated more than 216 million in tax revenue from sports betting.

The gambling section of the Constitution Montana Code Annotated 2019 Article III. How did legal sports betting in Montana become a reality. The state that reported the second-highest hold for the month of October was Montana 129 who has one of the most aggressive sports betting taxation policies in the United States.

Montana has a 69 state tax on gambling winnings. Montana Gambling Control Division takes gambling crimes very seriously. This is not restricted to casinos and can include bars hotels.

States have set rules on betting including rules on taxing bets in a variety of ways. Montana Gambling Tax. Large gambling wins over 600 in the state of Montana may possibly attract an additional Federal.

So lets now assess the Montana sports betting tax rate. When sports betting was legalized the. How States Tax Sports Betting Winnings.

The tax rate for the HB 725 bill has yet to be confirmed. This does not explicitly state sports betting but. Montana sports betting law allows players to bet in person at locations that carry a Montana Lottery sports license.

Sports betting in Montana is legal. The only change that we are likely to see with regards to Montana Lottery sports betting in 2022 is an increased number of locations. Use this page to report suspicious Gambling Liquor or Tobacco related activities in Montana.

This is in line with the national trends where the majority of states have opted for lower rates. However a figure of between 85 and 10 is expected. The legal gambling age in Montana is 18 years.

The Video Gambling Machine Tax isnt collected on the American Indian tribal betting operators. General Government Part III Section 9 states All forms of. The exceptions to the rule are Delaware New Hampshire and Rhode Island which.

Commonly sports betting operators have revenue known as hold of 5 percent of the handle which means that for every 100 you wager the operator takes 5 of which they. The Video Gambling Machine Tax the major gambling tax in Montana is equal to 15 percent of VGM expendi- tures which are.

Montana Sports Bettors Wagered 46 Million In 2021 But Did They Win Missoula Current

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Montana Sports Bettors Wagered 46 Million In 2021 But Did They Win Missoula Current

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Indy Gaming Three Years Later No Action In D C To Raise Jackpot Tax Threshold The Nevada Independent

![]()

Sports Betting Revenue For Every State 2018 To Present

Study Reveals Allowable Deductions Impact Sports Betting Tax Receipts

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

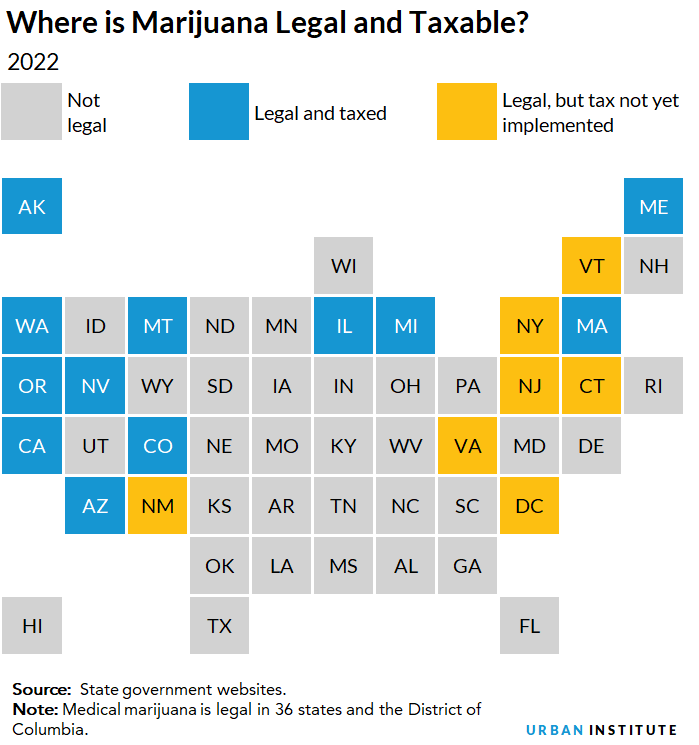

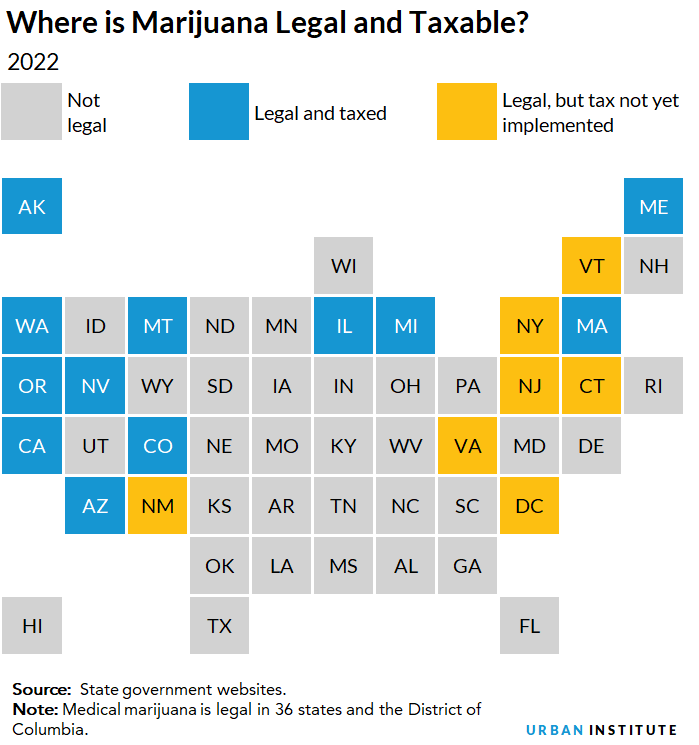

Marijuana Taxes Urban Institute

Sin Taxes On Sports Bets Legal Pot Gain Steam As Virus Rages

Paying Tax On Sports Betting Here S What You Need To Know

Draftkings Pepsi Prediction Challenge Free Cash Prize Contest Free Cash Challenges Cash Prize

Sin Taxes On Sports Bets Legal Pot Gain Steam As Virus Rages

Plan B Insist On 98k Bitcoin Price By End Of November And 135k By December In 2022 Bitcoin Price Bitcoin How To Plan

Study Reveals Allowable Deductions Impact Sports Betting Tax Receipts

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

Win Big Lose Big The Unforeseen Problems With Online Betting Gambling In Michigan

Win Big Lose Big The Unforeseen Problems With Online Betting Gambling In Michigan